An option is a contract to buy or sell a specific financial product .Options are financial instruments that convey the right, but not the obligation, to engage in a future transaction on some underlying security, or in a futures contract. The option is traded both on OTC and in the Exchange.A call option gives the holder the right to buy the underlying assert by certain date for a certain price.A put option gives the holder the right to sell the underlying assert by certain date for a certain price.The Price in the contract is known as strike price,the date in the contract is known as the maturity.

The theoretical value of an option can be determined by a variety of techniques. These models, which are developed by quantitative analysts, can also predict how the value of the option will change in the face of changing conditions. Hence, the risks associated with trading and owning options can be understood and managed with some degree of precision compared to some other investments.

Types of options

Exchange traded options are a class of exchange traded derivatives. Since the contracts are standardized, accurate pricing models are often available.

Over-the-counter options (OTC ) are traded between two private parties, and are not listed on an exchange. The terms of an OTC option are unrestricted and may be individually tailored to meet any business need.

Option styles

* European option - an option that may only be exercised on expiration.

* American option - an option that may be exercised on any trading day on or before expiration.

* Bermudan option - an option that may be exercised only on specified dates on or before expiration.

* Barrier option - any option with the general characteristic that the underlying security's price must reach some trigger level before the exercise can occur.

There are 4 types of option positions:

*A long position in call option

* A long position in put option

* A short position in call option

* A short position in put option

Sunday, September 7, 2008

Forward Contract

A forward contract is an agreement between two parties to buy or sell an asset at a specified point of time in the future. The forward price of such a contract is the spot price, which is the price at which the asset changes hands on the spot date.One of the party to a forward contract assumes a long position and agree to buy the underlying assert,on the other hand ,the other party assumes a short position and agree to sell the assert.

This process is used in financial operations to hedge risk, as a means of speculation, or so as to allow a party to take advantage of a quality of the underlying instrument which is time-sensitive.

The forward market is the over-the-counter financial market in contracts for future delivery, so called forward contracts. Forward contracts are personalized between parties. The forward market is a general term used to describe the informal market by which these contracts are entered into. Standardized forward contracts are called futures contracts and traded on a futures exchange.

This process is used in financial operations to hedge risk, as a means of speculation, or so as to allow a party to take advantage of a quality of the underlying instrument which is time-sensitive.

The forward market is the over-the-counter financial market in contracts for future delivery, so called forward contracts. Forward contracts are personalized between parties. The forward market is a general term used to describe the informal market by which these contracts are entered into. Standardized forward contracts are called futures contracts and traded on a futures exchange.

Future Contract

In finance ,futures contract is a standardized contract, traded on a futures exchange, to buy or sell a certain underlying instrument at a certain date in the future, at a specified price.. The price of the underlying asset on the delivery date is called the settlement price.

A futures contract gives the holder the obligation to buy or sell.The seller delivers the commodity to the buyer, or, if it is a cash-settled futures, then cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position has to offset his/her position by either selling a long position or buying back a short position, effectively closing out the futures position and its contract obligations.

Pricing

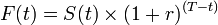

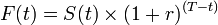

For a simple, non-dividend paying asset, the value of the future F(t), will be found by compounding the present value S(t) at time t to maturity T by the rate of risk-free return r.

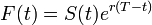

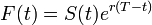

or, with continuous compounding

There are many different kinds of futures contracts, reflecting the many different kinds of tradable assets of which they are derivatives. For information on futures markets in specific underlying commodity markets, follow the links.

Futures traders are traditionally placed in one of two groups: hedgers, who have an interest in the underlying commodity and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and buying a commodity "on paper" for which they have no practical use.

Hedgers typically include producers and consumers of a commodity.

A futures contract gives the holder the obligation to buy or sell.The seller delivers the commodity to the buyer, or, if it is a cash-settled futures, then cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position has to offset his/her position by either selling a long position or buying back a short position, effectively closing out the futures position and its contract obligations.

Pricing

For a simple, non-dividend paying asset, the value of the future F(t), will be found by compounding the present value S(t) at time t to maturity T by the rate of risk-free return r.

or, with continuous compounding

There are many different kinds of futures contracts, reflecting the many different kinds of tradable assets of which they are derivatives. For information on futures markets in specific underlying commodity markets, follow the links.

Futures traders are traditionally placed in one of two groups: hedgers, who have an interest in the underlying commodity and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and buying a commodity "on paper" for which they have no practical use.

Hedgers typically include producers and consumers of a commodity.

Monday, August 18, 2008

Mutual Fund

A mutual fund is a professionally managed firm of collective investments that collects money from many investors and puts it in stocks, bonds, short-term money market instruments, and/or other securities.The fund manager, also known as portfolio manager, invests and trades the fund's underlying securities, realizing capital gains or losses and passing any proceeds to the individual investors.

Mutual funds can invest in many kinds of securities. The most common are cash instruments, stock, and bonds, but there are hundreds of sub-categories. Stock funds, for instance, can invest primarily in the shares of a particular industry, such as technology or utilities. These are known as sector funds. Bond funds can vary according to risk (e.g., high-yield junk bonds or investment-grade corporate bonds), type of issuers (e.g., government agencies, corporations, or municipalities), or maturity of the bonds (short- or long-term).

The net asset value, or NAV, is the current market value of a fund's holdings, less the fund's liabilities, usually expressed as a per-share amount. For most funds, the NAV is determined daily, after the close of trading on some specified financial exchange, but some funds update their NAV multiple times during the trading day. The public offering price, or POP, is the NAV plus a sales charge. Open-end funds sell shares at the POP and redeem shares at the NAV, and so process orders only after the NAV is determined.Closed-end funds (the shares of which are traded by investors) may trade at a higher or lower price than their NAV; this is known as a premium or discount, respectively. If a fund is divided into multiple classes of shares, each class will typically have its own NAV, reflecting differences in fees and expenses paid by the different classes.

Some mutual funds own securities which are not regularly traded on any formal exchange. These may be shares in very small or bankrupt companies; they may be derivatives; or they may be private investments in unregistered financial instruments (such as stock in a non-public company). In the absence of a public market for these securities, it is the responsibility of the fund manager to form an estimate of their value when computing the NAV. How much of a fund's assets may be invested in such securities is stated in the fund's prospectus.

Types of mutual funds

Open-end fund

The term mutual fund is the common name for what is classified as an open-end investment company by the SEC. Being open-ended means that, at the end of every day, the fund issues new shares to investors and buys back shares from investors wishing to leave the fund.

Exchange-traded funds

A relatively recent innovation, the exchange-traded fund or ETF, is often structured as an open-end investment company. ETFs combine characteristics of both mutual funds and closed-end funds. ETFs are traded throughout the day on a stock exchange, just like closed-end funds, but at prices generally approximating the ETF's net asset value. Most ETFs are index funds and track stock market indexes.

Exchange-traded funds are also valuable for foreign investors who are often able to buy and sell securities traded on a stock market.

Equity funds

Equity funds, which consist mainly of stock investments, are the most common type of mutual fund.

Bond funds

Types of bond funds include term funds, which have a fixed set of time (short-, medium-, or long-term) before they mature. Municipal bond funds generally have lower returns, but have tax advantages and lower risk. High-yield bond funds invest in corporate bonds, including high-yield or junk bonds. With the potential for high yield, these bonds also come with greater risk.

Money market funds

Money market funds entail the least risk, as well as lower rates of return.

Funds of funds

Funds of funds (FoF) are mutual funds which invest in other underlying mutual funds.The funds at the underlying level are typically funds which an investor can invest in individually. A fund of funds will typically charge a management fee which is smaller than that of a normal fund because it is considered a fee charged for asset allocation services. The fees charged at the underlying fund level do not pass through the statement of operations, but are usually disclosed in the fund's annual report, prospectus, or statement of additional information. The fund should be evaluated on the combination of the fund-level expenses and underlying fund expenses, as these both reduce the return to the investor.

Hedge funds

Some hedge fund managers are required to register with SEC as investment advisers under the Investment Advisers Act. The Act does not require an adviser to follow or avoid any particular investment strategies, nor does it require or prohibit specific investments. There may be a "lock-up" period, during which an investor cannot cash in shares.

Mutual funds can invest in many kinds of securities. The most common are cash instruments, stock, and bonds, but there are hundreds of sub-categories. Stock funds, for instance, can invest primarily in the shares of a particular industry, such as technology or utilities. These are known as sector funds. Bond funds can vary according to risk (e.g., high-yield junk bonds or investment-grade corporate bonds), type of issuers (e.g., government agencies, corporations, or municipalities), or maturity of the bonds (short- or long-term).

The net asset value, or NAV, is the current market value of a fund's holdings, less the fund's liabilities, usually expressed as a per-share amount. For most funds, the NAV is determined daily, after the close of trading on some specified financial exchange, but some funds update their NAV multiple times during the trading day. The public offering price, or POP, is the NAV plus a sales charge. Open-end funds sell shares at the POP and redeem shares at the NAV, and so process orders only after the NAV is determined.Closed-end funds (the shares of which are traded by investors) may trade at a higher or lower price than their NAV; this is known as a premium or discount, respectively. If a fund is divided into multiple classes of shares, each class will typically have its own NAV, reflecting differences in fees and expenses paid by the different classes.

Some mutual funds own securities which are not regularly traded on any formal exchange. These may be shares in very small or bankrupt companies; they may be derivatives; or they may be private investments in unregistered financial instruments (such as stock in a non-public company). In the absence of a public market for these securities, it is the responsibility of the fund manager to form an estimate of their value when computing the NAV. How much of a fund's assets may be invested in such securities is stated in the fund's prospectus.

Types of mutual funds

Open-end fund

The term mutual fund is the common name for what is classified as an open-end investment company by the SEC. Being open-ended means that, at the end of every day, the fund issues new shares to investors and buys back shares from investors wishing to leave the fund.

Exchange-traded funds

A relatively recent innovation, the exchange-traded fund or ETF, is often structured as an open-end investment company. ETFs combine characteristics of both mutual funds and closed-end funds. ETFs are traded throughout the day on a stock exchange, just like closed-end funds, but at prices generally approximating the ETF's net asset value. Most ETFs are index funds and track stock market indexes.

Exchange-traded funds are also valuable for foreign investors who are often able to buy and sell securities traded on a stock market.

Equity funds

Equity funds, which consist mainly of stock investments, are the most common type of mutual fund.

Bond funds

Types of bond funds include term funds, which have a fixed set of time (short-, medium-, or long-term) before they mature. Municipal bond funds generally have lower returns, but have tax advantages and lower risk. High-yield bond funds invest in corporate bonds, including high-yield or junk bonds. With the potential for high yield, these bonds also come with greater risk.

Money market funds

Money market funds entail the least risk, as well as lower rates of return.

Funds of funds

Funds of funds (FoF) are mutual funds which invest in other underlying mutual funds.The funds at the underlying level are typically funds which an investor can invest in individually. A fund of funds will typically charge a management fee which is smaller than that of a normal fund because it is considered a fee charged for asset allocation services. The fees charged at the underlying fund level do not pass through the statement of operations, but are usually disclosed in the fund's annual report, prospectus, or statement of additional information. The fund should be evaluated on the combination of the fund-level expenses and underlying fund expenses, as these both reduce the return to the investor.

Hedge funds

Some hedge fund managers are required to register with SEC as investment advisers under the Investment Advisers Act. The Act does not require an adviser to follow or avoid any particular investment strategies, nor does it require or prohibit specific investments. There may be a "lock-up" period, during which an investor cannot cash in shares.

Friday, May 16, 2008

Bank

A banker or bank is a financial institution that acts as a payment agent for customers, and borrows and lends money. In some countries such as Germany and Japan banks are the primary owners of industrial corporations while in other countries such as the United States banks are prohibited from owning non-financial companies.

The first modern bank was founded in Italy in Genoa in 1406, its name was Banco di San Giorgio (Bank of St. George).

Banks act as payment agents by conducting checking or current accounts for customers, paying cheques drawn by customers on the bank, and collecting cheques deposited to customers' current accounts. Banks also enable customer payments via other payment methods such as telegraphic transfer, EFTPOS, and ATM.

Banks borrow money by accepting funds deposited on current account, accepting term deposits and by issuing debt securities such as banknotes and bonds. Banks lend money by making advances to customers on current account, by making instalment loans, and by investing in marketable debt securities and other forms of lending.

Banks provide almost all payment services, and a bank account is considered indispensable by most businesses, individuals and governments. Non-banks that provide payment services such as remittance companies are not normally considered an adequate substitute for having a bank account.

Banks borrow most funds borrowed from households and non-financial businesses, and lend most funds lent to households and non-financial businesses, but non-bank lenders provide a significant and in many cases adequate substitute for bank loans, and money market funds, cash management trusts and other non-bank financial institutions in many cases provide an adequate substitute to banks for lending savings to.

The first modern bank was founded in Italy in Genoa in 1406, its name was Banco di San Giorgio (Bank of St. George).

Banks act as payment agents by conducting checking or current accounts for customers, paying cheques drawn by customers on the bank, and collecting cheques deposited to customers' current accounts. Banks also enable customer payments via other payment methods such as telegraphic transfer, EFTPOS, and ATM.

Banks borrow money by accepting funds deposited on current account, accepting term deposits and by issuing debt securities such as banknotes and bonds. Banks lend money by making advances to customers on current account, by making instalment loans, and by investing in marketable debt securities and other forms of lending.

Banks provide almost all payment services, and a bank account is considered indispensable by most businesses, individuals and governments. Non-banks that provide payment services such as remittance companies are not normally considered an adequate substitute for having a bank account.

Banks borrow most funds borrowed from households and non-financial businesses, and lend most funds lent to households and non-financial businesses, but non-bank lenders provide a significant and in many cases adequate substitute for bank loans, and money market funds, cash management trusts and other non-bank financial institutions in many cases provide an adequate substitute to banks for lending savings to.

Wednesday, April 30, 2008

Law of banking

Banking law is based on a contractual analysis of the relationship between the bank and the customer. The definition of bank is given above, and the definition of customer is any person for whom the bank agrees to conduct an account.

The law implies rights and obligations into this relationship as follows:

1. The bank account balance is the financial position between the bank and the customer, when the account is in credit, the bank owes the balance to the customer, when the account is overdrawn, the customer owes the balance to the bank.

2. The bank engages to pay the customer's cheques up to the amount standing to the credit of the customer's account, plus any agreed overdraft limit.

3. The bank may not pay from the customer's account without a mandate from the customer, e.g. a cheque drawn by the customer.

4. The bank engages to promptly collect the cheques deposited to the customer's account as the customer's agent, and to credit the proceeds to the customer's account.

5. The bank has a right to combine the customer's accounts, since each account is just an aspect of the same credit relationship.

6. The bank has a lien on cheques deposited to the customer's account, to the extent that the customer is indebted to the bank.

7. The bank must not disclose the details of the transactions going through the customer's account unless the customer consents, there is a public duty to disclose, the bank's interests require it, or under compulsion of law.

8. The bank must not close a customer's account without reasonable notice to the customer, because cheques are outstanding in the ordinary course of business for several days.

These implied contractual terms may be modified by express agreement between the customer and the bank. The statutes and regulations in force in the jurisdiction may also modify the above terms and/or create new rights, obligations or limitations relevant to the bank-customer relationship.

The law implies rights and obligations into this relationship as follows:

1. The bank account balance is the financial position between the bank and the customer, when the account is in credit, the bank owes the balance to the customer, when the account is overdrawn, the customer owes the balance to the bank.

2. The bank engages to pay the customer's cheques up to the amount standing to the credit of the customer's account, plus any agreed overdraft limit.

3. The bank may not pay from the customer's account without a mandate from the customer, e.g. a cheque drawn by the customer.

4. The bank engages to promptly collect the cheques deposited to the customer's account as the customer's agent, and to credit the proceeds to the customer's account.

5. The bank has a right to combine the customer's accounts, since each account is just an aspect of the same credit relationship.

6. The bank has a lien on cheques deposited to the customer's account, to the extent that the customer is indebted to the bank.

7. The bank must not disclose the details of the transactions going through the customer's account unless the customer consents, there is a public duty to disclose, the bank's interests require it, or under compulsion of law.

8. The bank must not close a customer's account without reasonable notice to the customer, because cheques are outstanding in the ordinary course of business for several days.

These implied contractual terms may be modified by express agreement between the customer and the bank. The statutes and regulations in force in the jurisdiction may also modify the above terms and/or create new rights, obligations or limitations relevant to the bank-customer relationship.

Subscribe to:

Posts (Atom)