A futures contract gives the holder the obligation to buy or sell.The seller delivers the commodity to the buyer, or, if it is a cash-settled futures, then cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position has to offset his/her position by either selling a long position or buying back a short position, effectively closing out the futures position and its contract obligations.

Pricing

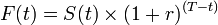

For a simple, non-dividend paying asset, the value of the future F(t), will be found by compounding the present value S(t) at time t to maturity T by the rate of risk-free return r.

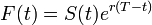

or, with continuous compounding

There are many different kinds of futures contracts, reflecting the many different kinds of tradable assets of which they are derivatives. For information on futures markets in specific underlying commodity markets, follow the links.

Futures traders are traditionally placed in one of two groups: hedgers, who have an interest in the underlying commodity and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and buying a commodity "on paper" for which they have no practical use.

Hedgers typically include producers and consumers of a commodity.

0 comments:

Post a Comment