An option is a contract to buy or sell a specific financial product .Options are financial instruments that convey the right, but not the obligation, to engage in a future transaction on some underlying security, or in a futures contract. The option is traded both on OTC and in the Exchange.A call option gives the holder the right to buy the underlying assert by certain date for a certain price.A put option gives the holder the right to sell the underlying assert by certain date for a certain price.The Price in the contract is known as strike price,the date in the contract is known as the maturity.

The theoretical value of an option can be determined by a variety of techniques. These models, which are developed by quantitative analysts, can also predict how the value of the option will change in the face of changing conditions. Hence, the risks associated with trading and owning options can be understood and managed with some degree of precision compared to some other investments.

Types of options

Exchange traded options are a class of exchange traded derivatives. Since the contracts are standardized, accurate pricing models are often available.

Over-the-counter options (OTC ) are traded between two private parties, and are not listed on an exchange. The terms of an OTC option are unrestricted and may be individually tailored to meet any business need.

Option styles

* European option - an option that may only be exercised on expiration.

* American option - an option that may be exercised on any trading day on or before expiration.

* Bermudan option - an option that may be exercised only on specified dates on or before expiration.

* Barrier option - any option with the general characteristic that the underlying security's price must reach some trigger level before the exercise can occur.

There are 4 types of option positions:

*A long position in call option

* A long position in put option

* A short position in call option

* A short position in put option

Sunday, September 7, 2008

Forward Contract

A forward contract is an agreement between two parties to buy or sell an asset at a specified point of time in the future. The forward price of such a contract is the spot price, which is the price at which the asset changes hands on the spot date.One of the party to a forward contract assumes a long position and agree to buy the underlying assert,on the other hand ,the other party assumes a short position and agree to sell the assert.

This process is used in financial operations to hedge risk, as a means of speculation, or so as to allow a party to take advantage of a quality of the underlying instrument which is time-sensitive.

The forward market is the over-the-counter financial market in contracts for future delivery, so called forward contracts. Forward contracts are personalized between parties. The forward market is a general term used to describe the informal market by which these contracts are entered into. Standardized forward contracts are called futures contracts and traded on a futures exchange.

This process is used in financial operations to hedge risk, as a means of speculation, or so as to allow a party to take advantage of a quality of the underlying instrument which is time-sensitive.

The forward market is the over-the-counter financial market in contracts for future delivery, so called forward contracts. Forward contracts are personalized between parties. The forward market is a general term used to describe the informal market by which these contracts are entered into. Standardized forward contracts are called futures contracts and traded on a futures exchange.

Future Contract

In finance ,futures contract is a standardized contract, traded on a futures exchange, to buy or sell a certain underlying instrument at a certain date in the future, at a specified price.. The price of the underlying asset on the delivery date is called the settlement price.

A futures contract gives the holder the obligation to buy or sell.The seller delivers the commodity to the buyer, or, if it is a cash-settled futures, then cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position has to offset his/her position by either selling a long position or buying back a short position, effectively closing out the futures position and its contract obligations.

Pricing

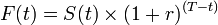

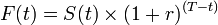

For a simple, non-dividend paying asset, the value of the future F(t), will be found by compounding the present value S(t) at time t to maturity T by the rate of risk-free return r.

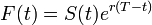

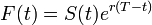

or, with continuous compounding

There are many different kinds of futures contracts, reflecting the many different kinds of tradable assets of which they are derivatives. For information on futures markets in specific underlying commodity markets, follow the links.

Futures traders are traditionally placed in one of two groups: hedgers, who have an interest in the underlying commodity and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and buying a commodity "on paper" for which they have no practical use.

Hedgers typically include producers and consumers of a commodity.

A futures contract gives the holder the obligation to buy or sell.The seller delivers the commodity to the buyer, or, if it is a cash-settled futures, then cash is transferred from the futures trader who sustained a loss to the one who made a profit. To exit the commitment prior to the settlement date, the holder of a futures position has to offset his/her position by either selling a long position or buying back a short position, effectively closing out the futures position and its contract obligations.

Pricing

For a simple, non-dividend paying asset, the value of the future F(t), will be found by compounding the present value S(t) at time t to maturity T by the rate of risk-free return r.

or, with continuous compounding

There are many different kinds of futures contracts, reflecting the many different kinds of tradable assets of which they are derivatives. For information on futures markets in specific underlying commodity markets, follow the links.

Futures traders are traditionally placed in one of two groups: hedgers, who have an interest in the underlying commodity and are seeking to hedge out the risk of price changes; and speculators, who seek to make a profit by predicting market moves and buying a commodity "on paper" for which they have no practical use.

Hedgers typically include producers and consumers of a commodity.

Subscribe to:

Comments (Atom)